Rockstart, a prominent European accelerator with its headquarters in Colombia, has unveiled a major investment plan to inject $6 million into 30 early-stage companies across Latin America over the next three years through its highly personalized acceleration program.

Currently, Rockstart has opened applications for the first batch of 10 startups, each of which will receive $10,000 in exchange for 6% equity for Rockstart.

In a press release, the accelerator highlighted the program’s unique approach, tailored to meet the specific needs of each selected startup. With only 10 companies accepted per year, Rockstart provides personalized mentoring and support, addressing both business and personal challenges faced by founders.

Rockstart proudly asserts that 80% of the startups that have undergone its program have successfully raised capital after participation, experiencing significant three-fold growth in size.

One standout feature of the program is its share repurchase guarantee, allowing entrepreneurs dissatisfied with the program to terminate the initial contract. This attractive offering attracts over 2,300 applications from entrepreneurs across the region.

Selected startups will receive lifelong support from Rockstart, including access to prestigious events like the International Investor Summit, soft landing programs in other countries, and mentorship from renowned founders in Latin America, such as Simón Borrero from Rappi, Jose Velez from Bold, Jose Calderon from Robinfood, Jose Bonilla from Chipper, and several other influential ecosystem leaders.

Founded in the Netherlands in 2011, Rockstart ventured into Bogotá seven years ago and has already invested $4 million in 51 companies, primarily focusing on energy, agri-food, and emerging technology sectors.

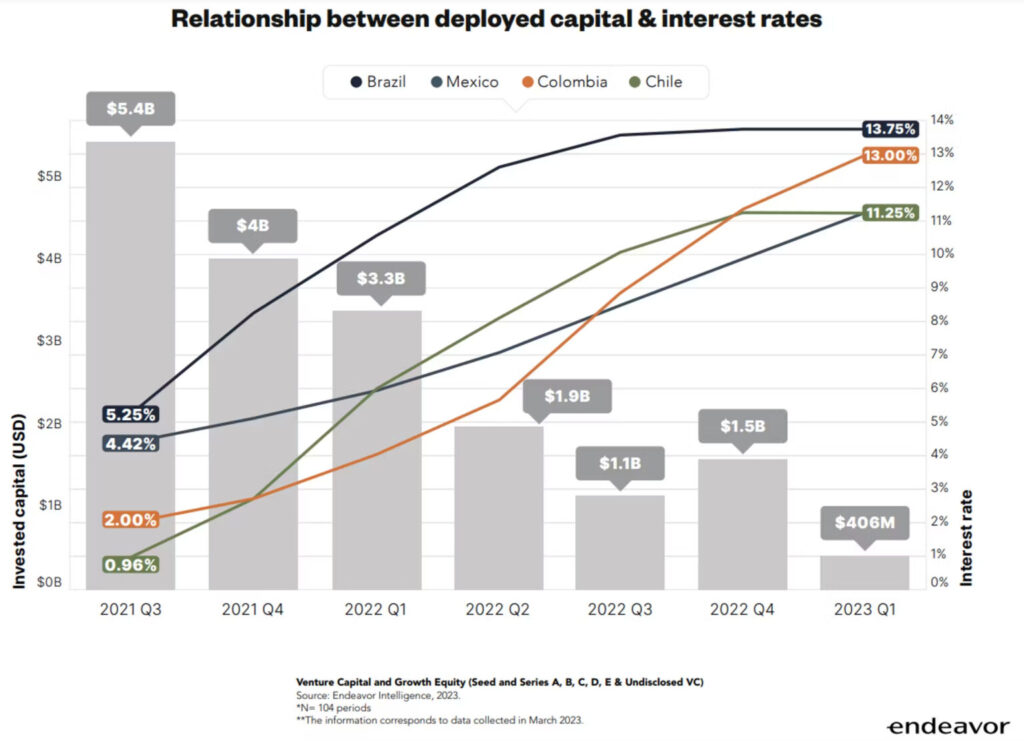

The Rockstart program arrives at a crucial time, as a study conducted by Endeavor and Glisco Partners reveals that Latin American startups raised $406 million in the first quarter of 2023, indicating a recovery but a slowdown compared to previous years. Early-stage startup funding also experienced a decline in Q1 2023, raising concerns in the region.

The commitment of an established company like Rockstart to an emerging market demonstrates confidence in the region’s recovery and a robust belief in the potential of startups.

Investment funds in the region find Rockstart’s involvement particularly relevant, given the complex financing landscape for startups in Latin America. The accelerator’s endorsement and track record of successful scaling provide potential opportunities for other investors.

For early-stage startups in the region, Rockstart’s solid portfolio, coupled with a community of renowned entrepreneurs, mentors, investors, and stakeholders, offers invaluable support for their growth journey.

The equity back option offered by Rockstart not only acts as a program guarantee but also provides flexibility for startups to explore alternative paths. With its substantial investment and expertise, Rockstart is poised to play a pivotal role in propelling Latin American startups to greater heights.

Also Read: 10 Top NFT Marketplace Startups in Florida