Investing can be a daunting and confusing task for many people, especially for those who lack the time, knowledge, or resources to manage their own portfolios. Many traditional investment advisors charge high fees, require high minimums, or offer generic products that may not suit the individual needs and goals of their clients. Moreover, many online platforms or apps that claim to democratize investing are often too simplistic, risky, or unreliable.

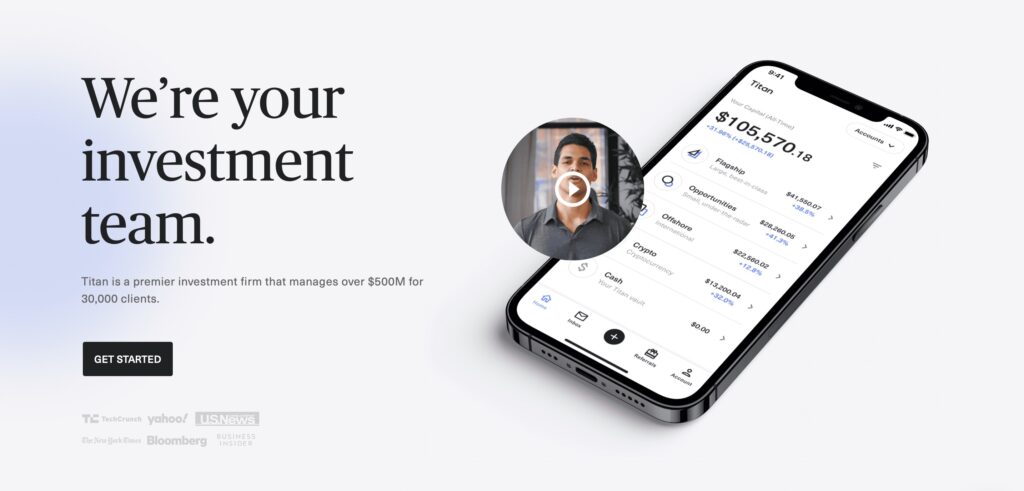

Titan is a startup that is changing the game by offering a world-class investment firm inside a mobile app. Titan manages over $750M+ in assets for 50,000+ clients, and aims to build the first premium investment manager for everyone. Titan combines the best of both worlds: the expertise and performance of a top-tier hedge fund, and the accessibility and convenience of a modern fintech app. In this blog post, we will explore how Titan is disrupting the investment industry with its innovative features and benefits.

Titan offers personalized and diversified portfolios

One of the main features of Titan is its ability to offer personalized and diversified portfolios for its clients. Titan does not use ETFs, mutual funds, or robo-advisors, but instead invests directly in individual stocks that are hand-picked by its team of experienced analysts. Titan offers three different strategies: Flagship (large-cap U.S. stocks), Opportunities (small/mid-cap U.S. stocks), and Offshore (international stocks). Each strategy has its own risk-return profile, investment thesis, and performance track record.

Titan also tailors each portfolio to the client’s preferences and goals, such as risk tolerance, time horizon, and tax situation. Titan uses a proprietary algorithm to adjust each portfolio’s exposure to the market, ranging from 0% (fully hedged) to 100% (fully invested). Titan also allows clients to customize their portfolios by excluding certain stocks or sectors that they do not want to invest in.

Titan provides transparent and engaging communication

Another feature of Titan is its ability to provide transparent and engaging communication for its clients. Titan does not keep its clients in the dark, but instead educates them about their investments and the market. Titan sends daily updates, weekly podcasts, monthly reports, and quarterly letters to its clients, explaining the rationale behind each portfolio decision, the performance of each stock, and the outlook for each strategy. Titan also provides live chat support, where clients can ask questions or give feedback to the Titan team.

Titan also makes investing fun and rewarding for its clients. Titan gamifies investing by offering badges, achievements, referrals, and rewards for its clients. Titan also creates a sense of community among its clients by hosting events, webinars, surveys, and contests. Titan also encourages its clients to share their opinions and ideas with the Titan team and other clients through social media platforms such as Twitter or Instagram.

Titan delivers exceptional results and value

Another feature of Titan is its ability to deliver exceptional results and value for its clients. Titan does not charge any commissions or hidden fees, but only a simple annual fee of 1% (or 0.75% for accounts over $10K). Titan also does not require any minimums or lock-ups, but allows clients to start investing with as little as $100 and withdraw their money anytime without any penalties.

Titan also outperforms most of its competitors and benchmarks. According to its website, Titan’s Flagship strategy has returned 331% since inception in 2018, compared to 74% for the S&P 500 index. Titan’s Opportunities strategy has returned 206% since inception in 2019, compared to 49% for the Russell 2000 index. Titan’s Offshore strategy has returned 53% since inception in 2020, compared to 25% for the MSCI EAFE index.

Titan is backed by prominent investors and recognized by prestigious awards

Titan is not only loved by its clients, but also by its investors and peers. Titan recently raised a $58M Series B round led by venture capital firm Andreessen Horowitz, bringing its total funding to $75M. Titan’s investors and board members include some of Silicon Valley’s best, such as Ashton Kutcher, Kevin Durant, Marc Benioff, Lee Fixel, BoxGroup, Sound Ventures, etc.

Titan also won several awards and accolades for its innovation and excellence. Titan won the Best Investment Advisor award from U.S. News in 2020 and the Best Advisor award at the 2020 Benzinga Global Fintech Awards. Titan also ranked #1 out of 60+ advisors 5x in a row and was featured by Apple in 2020.

Conclusion

Titan is a startup that is offering a world-class investment firm inside a mobile app. Titan manages over $750M+ in assets for 50,000+ clients, and aims to build the first premium investment manager for everyone. Titan combines the best of both worlds: the expertise and performance of a top-tier hedge fund, and the accessibility and convenience of a modern fintech app. Titan supports various features and benefits, such as offering personalized and diversified portfolios, providing transparent and engaging communication, delivering exceptional results and value, and being backed by prominent investors and recognized by prestigious awards. Titan is disrupting the investment industry with its innovative features and benefits.

If you are interested in learning more about Titan, or want to sign up for a free trial, please visit their website or download their app.

Also Read: How CloudDefense Is Revolutionizing Cloud Security With Its Next-Gen Platform